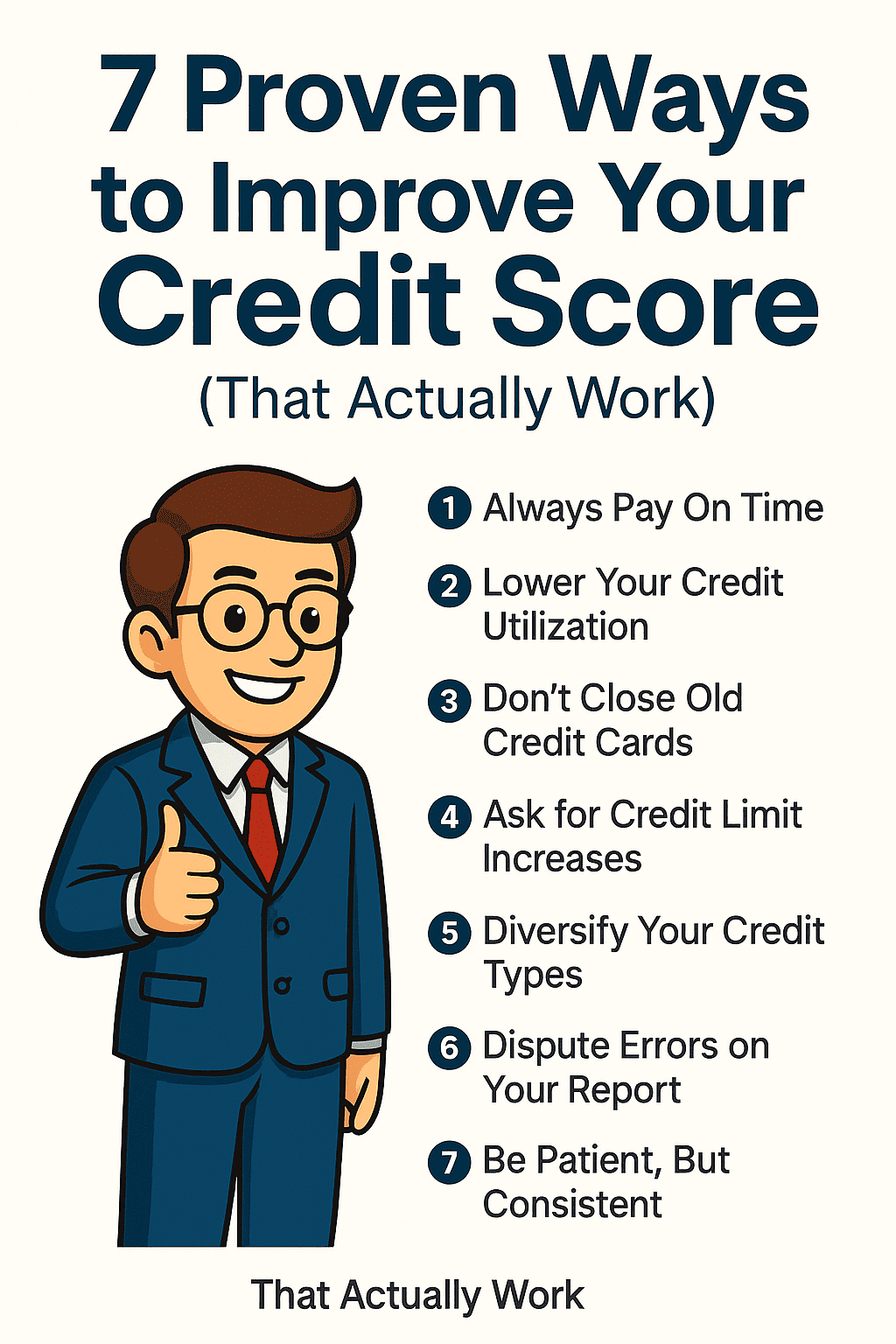

7 Proven Ways to Improve Your Credit Score (That Actually Work)

1. Always Pay On Time — No Exceptions

This is the single most important factor in your credit score. Even one missed payment can hurt.

Set up autopay. Use calendar reminders. Do whatever it takes — but never miss a due date.

I once worked with a client whose score dropped 60 points after a single 30-day late payment on a department store card she forgot existed.

2. Lower Your Credit Utilization

Try to keep your credit card balances under 30% of your limit — under 10% is even better.

If you’re carrying $900 on a $1,000 limit, lenders see risk. If you’re carrying $90, they see control.

Paying down one card from 70% to 20% raised one of my client’s scores by 42 points in 2 months.

3. Don’t Close Old Credit Cards

Length of credit history matters. An old card with no annual fee? Keep it open.

Just make a small charge every few months and pay it off.

Closing your oldest account can shorten your credit age and drop your score.

4. Ask for Credit Limit Increases

Call your card issuer and ask if you’re eligible for a credit limit increase — without a hard inquiry.

More available credit = lower utilization = better score (as long as you don’t spend more).

5. Diversify Your Credit Types

Installment loans + credit cards = a balanced profile.

Having just one type (like only credit cards) isn’t ideal. If you can responsibly manage it, add variety over time.

6. Dispute Errors on Your Report

Check your report for mistakes using AnnualCreditReport.com.

Dispute anything that’s inaccurate or outdated. Use certified mail and keep copies.

7. Be Patient, But Consistent

Good credit doesn’t happen overnight. But it does happen.

If you follow these steps for 6–12 months, your score will climb — and stay there.

I’ve seen people go from 580 to 720 in under a year just by staying focused.

✍️ Final Word (no “Final Thoughts” style)

Credit improvement isn’t glamorous. It’s not fast. But it’s real — and it works.

Forget shortcuts. Focus on progress.

Stick with the process, and before long, you won’t recognize your old credit score.